I am frustrated with a lot of scammers selling mentorship programmes/signals when they haven’t even made a penny from trading themselves. The reason why I have decided to post this is because I have had several emails from people complaining that they have spent thousands of dollars following these so called mentors. I think in the trading industry there are more mentors/education providers than traders. Some people struggle to save ,money and someone just comes takes it away with false promises of tutoring them to success.Lets set this right so that new traders or struggling traders stop buying useless courses online or following scammers. When looking for a mentor, follow the rules below

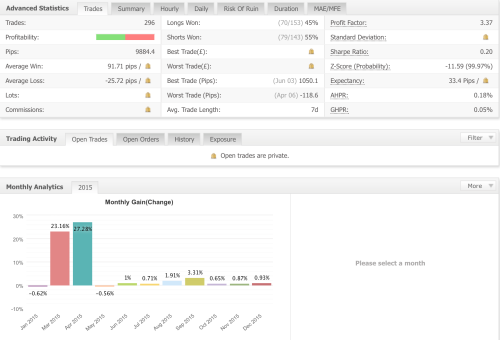

- Ask for trading statements (for at least 5 years, real brokers account not excel spreadsheets), if they cant provide that or come with excuses, run with your money. I don’t see any reason why they cant show you their success…coz you are paying them a lot of money, they should show proof that they trade successfully.

- Not all good traders are good mentors, its difficult to tell, but shop around for ones with good reputation.

- Have a small interview with the mentor to find out if the strategy will suit you, a mentor helps to discover who you are as a trader.

- Some mentors know that when they mention trading for a fund or working on wall street they will attract a huge number of students. Ask for proof, anyone can make a story. If they were successful on wall street or hedge fund why are they still selling courses for $100, that doesn’t add up.

- Gone are the days when you are shown some yachts and trading on the beach and you buy it, ask yourself if that is real and if it is maybe it is funded by selling course not trading. Still goes back to asking for proof of trading.

After saying all this, I am not saying that all mentors are scammers, that will be wrong, because they are some good and genuine mentors out there, but they are difficult to find. When you buy a car or a house you take your time and you shop around to make sure you have the best deal. Do the same when looking for a mentor, you are paying them thousands of dollars, so you are allowed to find out if they trade for a living, don’t listen to the bullshit of wanting to give back to the community. Charging someone $5000 for mentorship is not giving back to the community…That’s called reaping off the community !!!!!

Drop me in your comments, lets discuss what you think and tell us if you have been scammed or had a good mentor

Edited: 28 March 2016

Just as I posted last week about scammers look at this now

http://www.forexfactory.com/showthread.php?t=584527